Top 10 Health IT Trends For 2014

Compiled by Ken Congdon, Editor in Chief

By the closest margin in the history of our survey, Stage 2 EHR Meaningful Use edges out ICD-10 Compliance as the top health IT initiative among healthcare providers for 2014.

2013 will go down in history as a landmark year for healthcare in the U.S. Several significant events transpired (most notably, the launch of the Affordable Care Act) that will forever change the direction of care delivery in this country. Healthcare reform is impacting all aspects of the U.S. healthcare system — from physicians to payors and patients. Provider executives and administrators are feverishly planning and restructuring to ensure their facilities remain productive and profitable in this new era of healthcare. This involves not only cutting costs, but improving communication with other providers and clinical outcomes overall to ensure optimal reimbursement and minimal penalties. IT is playing a crucial role in this transformation. The digital revolution is well under way in healthcare (being propelled by government EHR Meaningful Use [MU] incentives), and technology solutions are being deployed nationwide to improve the flow, accessibility, and security of health data system-wide. However, since the healthcare industry has historically behaved laggardly in regard to IT adoption, there is a lot to accomplish in a limited time window. The IT demands being placed on the provider community today are staggering, and educated prioritization of technology initiatives can literally make or break a healthcare organization. To gain insight into which initiatives will carry the most weight with providers in 2014, Health IT Outcomes surveyed more than 264 healthcare providers from its readership.

RESEARCH SAMPLE

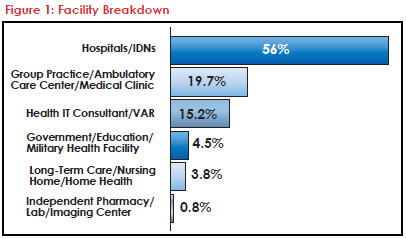

Health IT Outcomes’ 264 survey respondents were selected at random and are a fair representation of our total circulation of more than 53,000 IT decision makers from the healthcare provider community. The majority of respondents (56 percent) represented hospitals and integrated delivery networks (IDNs), followed by group practices/medical clinics/ambulatory care centers (19.4 percent). Some health IT consultants, systems integrators, and value-added resellers (15.2 percent) were also included in the survey, given their involvement in and influence over the health IT implementations of many healthcare providers. A complete facility breakdown of our survey respondents is presented in Figure 1.

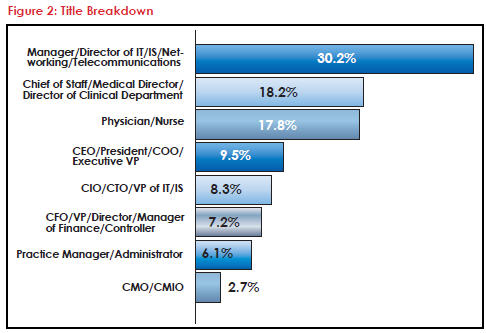

IT, clinical, and executive titles were well-represented in our sample, with IT leadership (including CIOs and CTOs) accounting for 38.5 percent of respondents, C-level executives (e.g. CEO, COO, CFO, CMO, CMIO, etc.) accounting for 25.5 percent, and clinical leaders accounting for 36 percent. Details regarding the complete title breakdown of our survey respondents can be found in Figure 2.

Of the hospitals and IDN contacts that responded to the survey, 27.4 percent were from hospitals with 500 beds or more, 15.3 percent were from hospitals with 300 to 499 beds, 23.6 percent represented hospitals with 100 to 299 beds, and 33.7 percent were from hospitals with fewer than 100 beds. Of the group practices, medical clinics, and ambulatory care centers that responded to the survey, 57 percent represented facilities with more than 50 physicians, 11.3 percent represented facilities with 26 to 49 physicians, 14 percent represented facilities with 10 to 25 physicians, and 17.7 percent represented facilities with 9 or fewer physicians.

Of the hospitals and IDN contacts that responded to the survey, 27.4 percent were from hospitals with 500 beds or more, 15.3 percent were from hospitals with 300 to 499 beds, 23.6 percent represented hospitals with 100 to 299 beds, and 33.7 percent were from hospitals with fewer than 100 beds. Of the group practices, medical clinics, and ambulatory care centers that responded to the survey, 57 percent represented facilities with more than 50 physicians, 11.3 percent represented facilities with 26 to 49 physicians, 14 percent represented facilities with 10 to 25 physicians, and 17.7 percent represented facilities with 9 or fewer physicians.

SURVEY METHODOLOGY

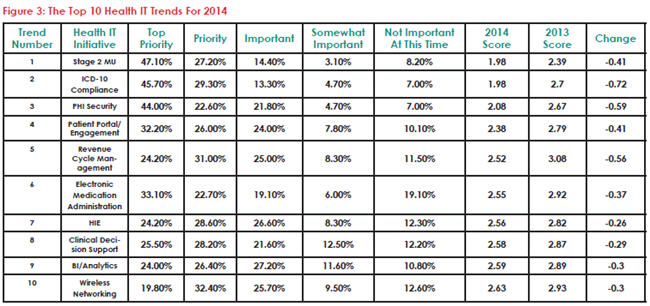

To identify the top technology trends, Health IT Outcomes asked each of the survey respondents to rank a series of technology initiatives in line with their implementation plans for 2014. For each initiative, respondents were asked to clarify whether the initiative was a “Top Priority,” a “Priority,” “Important,” “Somewhat Important,” or “Not Important At This Time.” Each response was then weighted. For example, all “Top Priority” responses were given a rating of one (1), while “Not Important At This Time” responses were given a rating of five (5). An average of the total ratings was then calculated for each IT initiative. The lower the cumulative rating, the higher the priority the technology project was to our survey respondents. This rating system was used to determine the Top 10 Health IT Trends for 2014. These top performing trends are outlined in Figure 3. For a complete list of how all the IT initiatives on our survey performed, visit www.HealthITOutcomes.com/2014_Top10.

KEY FINDINGS

KEY FINDINGS

The results of this year’s survey were so close that we needed to resort to a tiebreaker to determine the top health IT trend for 2014. Both Stage 2 EHR MU and ICD-10 Compliance finished with the lowest aggregate score of 1.98, but since a higher percentage of respondents ranked Stage 2 MU as a “Top Priority” than ICD-10 Compliance (47.1 percent versus 45.7 percent) it earned the esteemed position atop our 2014 rankings.

Not only was this year’s survey a lot more competitive than previous years, but it also revealed that providers seem to be approaching 2014 with more IT urgency than they did in 2013. For example, of the health IT initiatives listed on both our 2014 and 2013 surveys, all but one (Mobile/Tablet Computing) received a lower aggregate score this year than last year. That means each of these IT projects is being given a higher level of priority by our survey respondents in 2014.

The overall drop in aggregate scores is compelling. For example, the mean score of our Top 10 Health IT Trends in 2013 was 2.74; this year it was 2.38 — a difference of 0.36. This differential holds up when extended to account for all of the IT initiatives listed on the survey. In 2013, the mean score overall was 3.18; this year it was 2.78 — a difference of 0.40. Clearly, the vast majority of health IT projects are gaining favor with healthcare leaders in 2014.

As expected, the Top 10 Health IT Trends For 2014 include technology initiatives that were also represented on our 2013 list. In fact, 7 of the top 10 trends for 2014 carried over from last year (EHR MU [Stage 2 this year, Stage 1 last year], ICD-10 Compliance, PHI Security, Patient Portal/ Engagement, HIE, Clinical Decision Support, and BI/ Analytics). This isn’t surprising considering that many health IT projects (particularly EHR MU) are lengthy implementations that can extend over several years. More often than not, these implementations are never complete, but instead, continually enhanced and expanded.

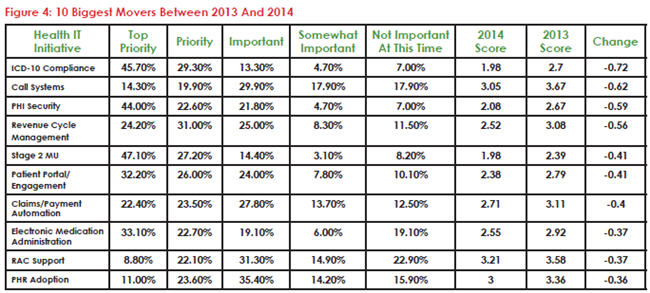

While our list of 2014 health IT trends is similar to our 2013 installment, there are some compelling new trends to crack our top 10 this year. For example, Revenue Cycle Management (RCM) was one of our biggest climbers this year — moving from the number 18 spot (with an aggregate score of 3.08) on our 2013 list to the number 5 health IT initiative (with an aggregate score of 2.52) according to this year’s survey. (A list of the 10 IT initiatives that made the most movement between 2013 and 2014 is provided in Figure 4.) The RCM data seems to suggest that providers are placing increased importance on solutions that will help them optimize cash flow — whether it’s reducing the administrative costs associated with processing and collecting payments, streamlining workflows to accelerate payment cycles, or ensuring timely payment from patients and payors. This effort is clearly understandable given the financial hardships healthcare reform and ICD-10 are expected to unleash on providers.

Electronic Medication Administration and Wireless Networking were the other two new IT initiatives to crack our top 10 list this year. Electronic Medication Administration came as a bit of a surprise to me, as I thought a majority of providers would have these solutions well-entrenched in their facilities by now in line with Stage 1 MU criteria. Wireless Networking, on the other hand, was an expected addition to the list. As more health data becomes digital, there is an increasing demand among clinicians to capture and access this information on the go. Doing so efficiently and securely all starts with the wireless infrastructure a provider has in place. In 2014, several providers will look to enhance and fortify their wireless networks to enable optimal productivity and security in a mobile world.

BIGGEST SURPRISES

To me, the most surprising revelation to come out of this year’s survey was the relatively low level of emphasis providers seem to be placing on mobile devices going into 2014. For example, Mobile/ Tablet Computing was the fourth most popular health IT initiative among providers according to our 2013 survey, but this year it plummeted to the 17th spot on our list. Moreover, it was the only IT initiative to have a higher aggregate score this year than it did last year (2.8 in 2014 versus 2.73 in 2013). Other device-related initiatives are also interspersed throughout the bottom half of our 2014 health IT trends list. For example, Mobile Device Management ranked 21st (3.0), Smartphones ranked 25th (3.03), Mobile Health Apps ranked 27th (3.08), and BYOD Management ranked last on our list with an aggregate score of 3.35.

This data is perplexing to me because it is contradictory to the reader activity occurring on our website and e-newsletters. For instance, 4 of the top 10 contributed articles on the Health IT Outcomes website in 2013 focused on mobile devices or mobile device management. Likewise, the two most popular news features published on our website in 2013 covered tablets and smartphones. It’s clear that mobile device strategy is important to our audience based on these readership trends. Why then did these interests not translate over to our survey in the form of higher prioritization of mobile device initiatives? There are several possible explanations. Perhaps health providers are realizing that they need to enhance their wireless infrastructures before they deploy mobile devices en masse, or maybe providers have already decided on their mobile platforms and have plenty of devices in play. Whatever the reason, I don’t think the results of this year’s survey are an indication that mobile device initiatives are unimportant to healthcare providers.

Another interesting observation from this year’s survey is the impact MU audits are having on healthcare providers. This year was the first time MU audits were listed as an initiative on our survey, because they didn’t even really exist until the tail end of 2012. These audits just missed making our Top 10 list, finishing in the 11th spot with an aggregate score of 2.67. I can’t blame providers for giving these audits such high priority given the money that is potentially at stake. However, I find this trend a bit disappointing, because it seems that providers will dedicate so much time and energy to simply proving they’ve done what they said they attested in previous years, instead of implementing new technology solutions that will advance their health IT prowess.

One final head-scratcher is the boost Call Systems received based on our survey results this year. Call Systems finished dead last according to our 2013 survey results with an aggregate score of 3.67. This year, the aggregate score for this initiative was 3.05. The only IT initiative with a higher point differential this year was ICD-10 Compliance with a 0.72 change between 2013 and 2014. Indeed, clinician communication and alerts are important to providers, but I don’t understand why this initiative is being attacked with more urgency this year than last. Moreover, I don’t see how the boost in this area wouldn’t coincide with a boost in many mobile initiatives, as many of today’s call systems are based on mobile platforms.

HOW MEANINGFUL IS MEANINGFUL USE?

2014 marks the third year we’ve conducted our annual Top 10 Health IT Trends survey, and each year EHR Adoption and MU (of one Stage or another) has topped our list. This isn’t surprising given the monetary incentives the federal government has dedicated to this movement. However, it led me to wonder — would the results of our survey (and health IT prioritization among providers) be vastly different if the MU program didn’t exist? For this reason, I added a couple questions to the survey this year in an attempt to gain a better understanding of the influence of MU. The first question prompted survey respondents to ignore government incentive dollars and mandates and select the technology inititative they believed had the most potential to have the biggest positive impact on the overall effectiveness, price performance, and care quality of their health facilities. Surprisingly, EHR Adoption and MU still received the most votes (31.8 percent), followed by BI/Analytics/Population Health Management (16.7 percent), Patient Portal/Patient Engagement (15.5 percent), Telehealth/mHealth/Remote Patient Monitoring (14.8 percent), ICD-10 (11.4 percent), and HIE (9.8 percent). The second question asked survey respondents to reveal what level of priority they would give EHR adoption and MU if the MU incentive program didn’t exist. A whopping 41.7 percent of respondents said they would still make implementing EHR technology their biggest IT priority. A slightly higher percentage (43.2 percent) said they would still focus on EHR initiatives, but other IT projects might take priority. Only 9.5 percent of respondents said they would place EHR initiatives on the back burner, and even fewer (5.7 percent) said they would not have considered implementing EHR technology at all.

NEXT STEPS

Obviously, I have only scratched the surface in examining the health IT trends uncovered as part of our annual survey. On the following pages, our editors and several health IT visionaries provide additional insight and commentary on our top 10 trends. Also, as mentioned, you can view a full list of the health IT initiatives that were included as part of our survey and how each ranked with our respondents (even if they didn’t make the top 10), by visiting www.HealthITOutcomes.com/2014_Top10.

Trend 10: Wireless Networking

4 Steps To Enhancing Your Wireless Network

By Health IT Outcomes Staff

Today’s clinicians demand to be mobile. These demands go far beyond simple voice, text, and email capabilities. Physicians and nurses want to access information-rich systems and applications (such as EHRs) wirelessly on their mobile devices. As a result, a reliable and powerful wireless network is no longer a “nice-to-have” commodity — it’s an essential part of your health IT infrastructure.

Most health providers have some sort of Wi-Fi network in place already, but oftentimes these networks were designed with a different purpose in mind (e.g. hospital guest networks, asset tracking, etc.). These existing networks may not be adequate enough to support EHR access and other data-rich applications. As such, many providers will be upgrading their Wi-Fi infrastructures in 2014 to enable a more extensive array of mobile capabilities. When upgrading your Wi-Fi network to support clinical data traffic, there are four key areas on which to focus:

Coverage – To create an effective clinical Wi-Fi network, a healthcare provider must strategically deploy technology to provide universal and optimal wireless coverage throughout a facility, in spite of known obstacles (e.g. architectural-related “black spots,” restricted areas, etc.).

Density – Many Wi-Fi guest networks were designed assuming a 1:1 ratio of people to mobile devices. However, many clinicians today use two or more mobile devices on the job. Furthermore, there are several wireless medical devices and asset-tracking solutions in play that also need access to Wi-Fi. Health providers need to use new math to design a wireless infrastructure that is dense enough to meet all of the facility’s current and future mobile demands.

Performance – Performance is essentially a function of bandwidth, and today’s EHR applications need a lot of it — approximately three megabits per second — to ensure quality service. If bandwidth drops below this level at any time, then the clinical experience can suffer and frustration can set in. Providers need to ensure their Wi-Fi networks provide the bandwidth necessary to fulfill desired application obligations.

Security – Securing a Wi-Fi network starts with proper authentication of both the individual and the device. You need to be able to confirm that clinicians are not only who they say they are, but that they’re using the device they’re supposed to be using for a specific function. Wi-Fi solutions that provide full integration with active directory, open directory, and RADIUS servers can help facilitate wireless authentication. Proper encryption of the network and devices is also a must.

Trend 9: BI/Analytics

Analytics Starts With Data, But Must End In Action

By Shahid Shah, The Healthcare IT Guy, www.healthcareguy.com

Over the coming years, MU-compliant “connected EHRs,” cooperative medical devices from the emerging wearables industry, and “accountable tech” will be generating more data than ever. Accountable tech is what I call health IT that truly enables the slow but promising move from fee-for-service (FFS)-based payments to value-driven and outcomes-based payments. Healthcare is not some system of payments or abstract concept of service — it’s what emerges from the millions of micro interactions and daily communications between providers, patients, and payors. Accountable tech starts with connected EHRs and fosters next-generation solutions that improve the relationship providers have with their patients during every encounter, using prospective and predictive analytics solutions, not through retrospective analytics and quarterly reports.

We’re suffering from disconnected EHRs today, and if we don’t fix that soon, accountable care organizations (ACOs) and value-driven and outcomes- based care won’t succeed fast enough, or at enough scale, for it to matter in the long run. The good news is that there is light at the end of the tunnel for data and workflow interoperability among some EHRs whose provider organizations prioritize it by punishing vendors that do not offer connectivity. An analytics solution that has terrific features, but can’t integrate seamlessly behind firewalls to reach into PM, financial, lab, and clinical applications isn’t practical or useful, and disconnected EHRs are both to blame and the place to look for salvation. Most EHR vendors must be dragged kicking and screaming into a world where they seamlessly and securely expose their data behind on-premise firewalls and transform it into queryable and reportable data in the cloud.

In 2013, we saw the merging of cloud, business intelligence (BI), analytics, and EHR capabilities into working solutions. In 2014, we should strive to achieve the real intentions of MU: evidence and data driving clinical decisions, not just documenting them. Analytics starts with data, but must end in insight or action. Usually, the insight or action we’re looking for is centered on changing the care of a patient to improve outcomes or adjusting the behavior of a patient toward more desirable adherence patterns.

In 2013, we saw the merging of cloud, business intelligence (BI), analytics, and EHR capabilities into working solutions. In 2014, we should strive to achieve the real intentions of MU: evidence and data driving clinical decisions, not just documenting them. Analytics starts with data, but must end in insight or action. Usually, the insight or action we’re looking for is centered on changing the care of a patient to improve outcomes or adjusting the behavior of a patient toward more desirable adherence patterns.

While single vendor solutions will continue to matter from a pure software point of view, we’re going to need the expertise of systems integrators to do the grunt work of connecting EHRs and analytics offerings. The most successful BI implementations will be those that allow transactional data to stay in PMs and EHRs but can federate statistical and correlation data from the transactional systems into the cloud. IT departments within provider organizations don’t have the time or expertise to install large new systems and do the integration necessary, so cloud-based analytics software, supported by experienced, usually outsourced, enterprise integration teams, will be the only real solution.

Most BI customers are now smart enough to not be fooled by pretty dashboards, fancy charts, and a bunch of “cool” demos, because they realize that without a lot of dirty work around data transformations, none of those BI features will work. In 2014, we must see data governance and data integration being elevated from a necessary evil and grunt work to a strategic competency that is clearly identified as the main risk in all BI and analytics projects. Choosing the right BI and tech vendor is certainly important, but no BI functionality will solve the problems of missing, incomplete, or invalid data.

The best place to start or continue with BI and analytics in 2014 will still be to improve mobility of clinical workflows. Taking output from analytic systems or data hubs and making it available in an email, a new mobile app, or a widget in an existing mobile app is probably more useful than trying to give users new systems to monitor and use.

Trend 8: Clinical Decision Support

CDS Must Overcome Alert Fatigue In 2014

By Katie Wike, Contributing Writer

The benefits of clinical decision support (CDS) tools are often debated in healthcare circles. Many believe that incorporating CDS into EHRs will improve quality of care, contain costs, and reduce overtreatment. Several studies exist that support this position. For example, a study by researchers at Virginia Mason Medical Center revealed that CDS tools built into radiology order-entry systems reduced unnecessary imaging for lower back pain, headaches, and sinusitis each by more than 20 percent. Another study by Mount Sinai School of Medicine showed that CDS helped reduce the prescription of unnecessary antibiotics. The list goes on and on.

While proof of the effectiveness of CDS clearly exists, many question whether these benefits are worth the interruptions CDS tools can sometimes introduce into clinical workflows. Physicians regularly complain of the “alert fatigue” often caused by CDS technology. And this is the root of one of the biggest obstacles standing in the way of widespread adoption of CDS and the potential benefits the technology can provide. With alert fatigue, physicians become desensitized to alerts because of the number of them and the frequency with which they are delivered. As a result, physicians start to ignore or override these alerts. This practice not only renders CDS technology useless, it can put patients at risk.

For example, a recent study published in The Journal of the American Medical Informatics Association (JAMIA) found that about half of CDS alerts were overridden by providers, but only half (53 percent) of these overrides were classified as “appropriate.” Instances where overrides are not appropriate can have catastrophic consequences.

For example, a recent study published in The Journal of the American Medical Informatics Association (JAMIA) found that about half of CDS alerts were overridden by providers, but only half (53 percent) of these overrides were classified as “appropriate.” Instances where overrides are not appropriate can have catastrophic consequences.

A case in point is provided in an article published earlier this year in Pediatrics. The article chronicled the hospitalization of a two-year-old boy whose EHR indicated an allergy to sulfonamide antibiotics. Clinical staff overrode more than 100 drug-allergy alerts to provide him with alternate medications. Tragically, the child died as a result of the medical error.

There is hope on the horizon for CDS, however. Technology refinements continue to be made to CDS tools to reduce instances of alert fatigue or make alerts more difficult to ignore. Furthermore, the JAMIA study indicated that instances of overriding varied greatly by alert type. Refinement of these alerts has the potential to improve the relevance of alerts, reduce alert fatigue, and prevent misuses of CDS and other EHR tools that can cause serious problems.

Trend 7: HIE

Sustainability And Value To Drive HIE Growth In 2014

By Linda Stotsky

What are the drivers for continued buy in and HIE growth in 2014? There are multiple models of “just the right” process for migrating data from disparate systems while mitigating risk; however, physicians aren’t sold on the ROI. A 30 percent increase in hospital use and 10 percent increase in ambulatory use can only be trumpeted as slow and steady. Stakeholders aren’t sure about long- term sustainability. Most grasp the intrinsic value, yet are still unsure of the business model.

Sustainability: The first driver of HIE adoption was MU. Federal grants boosted operational budgets. In the wake of a federal funding drought, HIEs became forced to look at sustainable funding from community models. To gain respect, HIEs developed stronger business acumen. A good example is Thrive HDS (Health Data Solutions). It’s a “for-profit” spin-off of the Indiana Health Information Exchange (IHIE). Thrive provides analytic services to boost the IHIE ecosystem. This broader context of adaptability and business management is what we will see more of in 2014. The Colorado Regional Health Information Exchange (CORHIO) charges subscription fees to participating providers. The subscription model isn’t new, but CORHIO includes additional “perks” to community stakeholders such as “free EHR implementation,” which increase physician buy-in and strengthen community involvement.

Accountable Care Organization (ACO) and Primary Care Medical Health Partners (PCMH): Quality initiatives and performance objectives of ACOs and PCMHs align quite nicely with HIEs. Meeting quality and performance metrics is easier with analytics from a regional HIE. Let me illustrate a typical case: Helen goes to her local physician for a prenatal workup. The physician cannot find any sign of pregnancy. He orders blood work and imaging to confirm the negative diagnosis. Helen is not convinced. Fueled by the overwhelming idea that she is pregnant, Helen continues to see seven additional providers. The last provider decides to log into the state HIE. He discovers Helen had a previous diagnosis of bipolar disorder. This stops redundant testing and initiates a correct diagnosis and effective treatment options. HIE analytics align quite nicely to “fill in the gaps” for payors, providers, hospitals, and patients. 2014 will see large IDNs and ACOs leverage the HIE platform for initiatives that include connectivity, interoperability, and quality reporting, all of which deliver clinical benefit and a proven financial ROI not found in the EHR.

Accountable Care Organization (ACO) and Primary Care Medical Health Partners (PCMH): Quality initiatives and performance objectives of ACOs and PCMHs align quite nicely with HIEs. Meeting quality and performance metrics is easier with analytics from a regional HIE. Let me illustrate a typical case: Helen goes to her local physician for a prenatal workup. The physician cannot find any sign of pregnancy. He orders blood work and imaging to confirm the negative diagnosis. Helen is not convinced. Fueled by the overwhelming idea that she is pregnant, Helen continues to see seven additional providers. The last provider decides to log into the state HIE. He discovers Helen had a previous diagnosis of bipolar disorder. This stops redundant testing and initiates a correct diagnosis and effective treatment options. HIE analytics align quite nicely to “fill in the gaps” for payors, providers, hospitals, and patients. 2014 will see large IDNs and ACOs leverage the HIE platform for initiatives that include connectivity, interoperability, and quality reporting, all of which deliver clinical benefit and a proven financial ROI not found in the EHR.

Usability: In the early days of HIE, clinical use was cumbersome. The absence of single-sign and alignment to existing workflows made buy- in difficult. We saw the same with early EHR implementation. As we move into 2014, we are seeing a second resurgence in the training and implementation necessary to align the HIE data to existing clinical architecture. Trainers work closely with end users, creating super users. Shared community records are becoming tightly integrated with emergency department workflows to create a better picture during transitions of care or gaps in care. Specialties such as behavioral health, mental health, and long-term care see the benefit of “increased data points” along the patient continuum.

HIE growth may have been tortoise-like in 2013, but we are going to see a steady increase in use and viability in 2014. Business innovation is the core value of intellectual capital. By gaining a higher level of business acumen, the strongest HIEs are already aligning operating performance with strategic positioning, providing a solid case for sustainability in a technology-driven world.

Trend 6: Electronic Medication Administration

Mobile Health Focused On Patient Safety

By Kathryn Nassberg, Analyst, VDC Research, www.VDCResearch.com

Research from VDC shows that investment drivers for mobile health are rooted in patient safety, care, and communications. This is borne out in a variety of applications that are both internal and external. Reducing medical and procedural errors is a key motivator. According to the Journal of Patient Safety, preventable harm is now the third leading cause of death in the United States, estimated at more than 400,000 deaths per year. As such, electronic medication administration is a prime area of focus for healthcare organizations today.

A key technology being leveraged to reduce the number of medication errors and adverse drug events (ADEs) is bar code medication administration (BCMA) systems. These solutions help match the correct patient with the correct medication and dose by scanning bar codes on patient wristbands and medication bottles for verification. These systems are also often integrated with EHR data. The popularity of BCMA systems is driven in part by MU guidelines, but also because of the impact they can have in the area of ADEs. For example, the FDA projected that BCMA systems alone could eliminate 500,000 ADEs, reduce medication errors by 50 percent, and generate $93 billion in cost savings over the next 20 years. Other technologies, such as secure mobile medication cabinets, can add another layer of security to medication administration processes.

Beyond patient safety, healthcare organizations are also looking to empower patients with mobile applications that streamline communications and efficiency of care. VDC’s research shows the primary application for organizations surveyed enables patients to contact their healthcare provider. Fifty-seven percent of survey respondents’ organizations currently support applications that enable patients to make appointments, and 46 percent enable patients to access lab results. Providing patients with the tools to communicate efficiently with their healthcare provider and access medical information helps to streamline overall organizational productivity, all while improving patient care and support.

Beyond patient safety, healthcare organizations are also looking to empower patients with mobile applications that streamline communications and efficiency of care. VDC’s research shows the primary application for organizations surveyed enables patients to contact their healthcare provider. Fifty-seven percent of survey respondents’ organizations currently support applications that enable patients to make appointments, and 46 percent enable patients to access lab results. Providing patients with the tools to communicate efficiently with their healthcare provider and access medical information helps to streamline overall organizational productivity, all while improving patient care and support.

While cost is an important factor, it is trumped by care within this sector. This dedication to patient care is made clear in the data. VDC data shows that the top metric used by healthcare organizations to measure their mobile healthcare solutions is improved patient care, by a considerable margin, with 52 percent of all organizations queried listing it among their top three metrics. This is followed by reduced medical and procedural errors and improved worker productivity, which are tied at 34 percent. The attention given to reducing errors is particularly high in the Americas, rating a full 5 percent higher than the global total. Additional emphasis is added to metrics that measure faster decision making and improved patient communication. This underscores the push to support mobile applications that improve patient care and safety first and foremost while promoting productivity and better communications.

Trend 5: Revenue Cycle Management

RCM: Evolve Or Face Extinction

By John Oncea, Editor

Let’s face it: You need to make money to stay in business. In the payor-dominated, fee-for-service environment that directed healthcare for years, providers developed sophisticated processes and invested in cutting-edge technologies to maximize reimbursement. Now, the revenue landscape is evolving, and so must you.

New payment models, a major coding transition, reimbursement cuts for several medical procedures, and a shift in the payor mix are combining to force health providers to adjust their processes accordingly to ensure they can reap the financial rewards of this new healthcare system. It’s becoming a financial survival of the fittest.

What can be done to avoid extinction? Well, many providers are investing in new revenue cycle management (RCM) technologies to help cut costs and ensure cash flow. The following are four ways providers are applying these tools.

Arm Yourself (And Your Patients) With Knowledge — Healthcare reform has changed the system, with about 9 million new people receiving coverage through provisions in the Affordable Care Act and estimates that as many as 21 million more will join them. Cost control efforts by patients and their employers will likely result in many opting for high-deductible health plans (HDHPs) to keep premiums low. The result? More claims and more denials.

Arm Yourself (And Your Patients) With Knowledge — Healthcare reform has changed the system, with about 9 million new people receiving coverage through provisions in the Affordable Care Act and estimates that as many as 21 million more will join them. Cost control efforts by patients and their employers will likely result in many opting for high-deductible health plans (HDHPs) to keep premiums low. The result? More claims and more denials.

Providers need to rely on automation tools such as claims management software and automated collections workflow engines to compensate for this increase in denials. Additionally, more patients utilizing HDHPs will place greater emphasis on up-front eligibility and collections solutions, with providers needing to know what each patient’s responsibility will be and make every effort to collect this payment up front.

Be The Best Choice For The New Breed Of Healthcare Shopper — The HHS’ open data initiative and the rise in HDHPs provides the foundation for comparison shopping for healthcare services. Health providers need to see how their pricing stacks up to competitors and be able to justify their pricing as well. Pricing analysis solutions can help you succeed in this era of growing price transparency by analyzing existing payor contracts and fee schedules. They also allow for hospitals and practices to compare prices with competitors and make necessary adjustments.

Volume. Volume. Volume. — It’s simple — get more revenue out of your existing assets. Hospitals can generate optimal revenue if ill patients fill open beds and healthy patients are effectively discharged. Many hospitals have inefficient patient flow processes that can be remedied with patient flow automation technologies. A second fix is simply a better timing of discharges, avoiding them during shift changes that cause inadvertent delays.

Analyze This. Analyze That. — Use analytics tools for more than just internal evaluations. New pay-for-performance models place an emphasis on quality improvement, both within your facility and against your competition. Keep in mind, reimbursement can still be cut if you don’t outperform other providers, and you need to leverage data analytics solutions to compare yourself to your peers and make any necessary adjustments.

Trend 4: Patient/Portal Engagement

2014: The Arrival Of Patient Engagement

By Jim Tate, President, EMR Advocate, www.EMRAdvocate.com

Patient engagement. Every time I hear that phrase I think about marriage proposals and wedding receptions. Until recently I thought “patient involvement” might be a more appropriate term, but I was wrong. The HITECH Act’s MU initiative clearly has an established directive to make healthcare providers the active and responsible parties to educate and encourage the public to become more involved in electronic access and communication. For 2014, this could possibly be the biggest challenge to achieving MU incentives.

First come the portals. For both eligible professionals (EP) and eligible hospitals (EH), the requirements are placed front and center to promote patient access. Patient data must be provided online so that patients can view, download, and transmit their information. Skip this requirement, and you can say goodbye to potential MU incentives. For those EPs and EHs at Stage 2, you have the additional pleasure of making sure at least 5 percent of unique patients (or their authorized representatives) seen or discharged during the reportable period actually access their portal data. This is but the first wave in which patient action is required to achieve MU. I expect we will see some creative workflows developed in 2014 to pull off this requirement.

EPs have even more to contend with in terms of patient engagement. How about meeting the requirement that “a secure message was sent by more than 5 percent of unique patients (or their authorized representatives) seen by the EP during the EHR reporting period”? That’s right. For Stage 2 EPs a core MU requirement is that patients have sent them a “secure message.”

EPs have even more to contend with in terms of patient engagement. How about meeting the requirement that “a secure message was sent by more than 5 percent of unique patients (or their authorized representatives) seen by the EP during the EHR reporting period”? That’s right. For Stage 2 EPs a core MU requirement is that patients have sent them a “secure message.”

I’m betting we will be not too far into 2014 before we hear the outcry from providers over the challenge of meeting the complexities of the first wave of required patient engagement functionality. We are witnessing a shift in the ability of patients to access their healthcare records and providers. Beyond the creation of new workflows is a more significant cultural change that is focused on patient rights. That is the real issue here and one that I anticipate will expand in Stage 3 and beyond.

Trend 3: PHI Security

The Costs Of PHI Security

By Mark Kadrich, Author of Endpoint Security

I was asked to talk briefly about why this past year has seen an increase in PHI security concerns. I thought about it for a few seconds — mobile, cloud, ACA (Affordable Care Act)? And then 1.5 million answers hit me like a filibuster — the Omnibus rule and the $1.5 million in fines per incident it can bring. Combine that with guilty until proven innocent pending a risk assessment, and you’ll start to get some attention. A million and a half here, a half million there, and it starts to add up to real money.

No matter where you look, there is going to be a lot of money spent dealing with PHI security in the next year. Whether you’re dealing with implementing new solutions or paying for your failures, it’s going to cost you.

Problem is, you’re essentially at the mercy of your partners. The days of doing your own thing and tossing it over the cube wall to a partner isn’t going to cut it anymore. Stringing vendor solutions together without an architecture to drive it will no longer work.

The smart money says you’ll spend on the front side trying to architect a solution to the problem instead of paying fines and trying to retrofit a random architecture.

The smart money says you’ll spend on the front side trying to architect a solution to the problem instead of paying fines and trying to retrofit a random architecture.

You may have noticed my use of the word “architecture,” and it is intentional. Being able to integrate mobility and cloud technology into your solution demands that you understand how it behaves before you change it. Your architecture must be a coherent one that is flexible, reliable, secure, and predictable in order to take into account the influence of mobility, cloud, and the innovations that are yet to be sprung on your unsuspecting security group.

In order to determine your architectural readiness, and thus your PHI security risk, ask yourself some simple questions:

1. Can your security people show you an architecture document?

2. Can they clearly and concisely explain why it works?

3. How long does it take to detect a breach?

4. How long does it take you to react to it?

5. Can you reliably detect a breach?

If the answer to 1 is no, I’m willing to bet the answer to 5 is no as well. Get out your checkbook.

Thankfully, none of the costs of solving the PHI security problem is going to be reflected in my healthcare premiums. Oh, wait ....

Trend 2: ICD-10 Compliance

How Not To Approach Your ICD-10 Transition

By Steve Sisko, Health IT Consultant/Blogger, www.shimcode.blogspot.com

The AMA’s fighting it. The New York Times writes stories about how silly it is. The Cutting Costly Codes Act of 2013 is designed to stop it. It’s Codeageddon! It’s an ICDapocalypse!

Here are five things you should do to ensure this warm, fuzzy ICD-10 feeling doesn’t go away:

1. Ignore the Big Picture — Keep thinking ICD- 10 is just another pesky government mandate; you’ll increase the likelihood of not identifying and addressing improvement opportunities both pre- and post-ICD-10 implementation.

The accelerating shift toward risk-sharing and global payment incorporates measurement components based on diagnosis codes. While not ideal, ICD-10 is here to stay.

The accelerating shift toward risk-sharing and global payment incorporates measurement components based on diagnosis codes. While not ideal, ICD-10 is here to stay.

2. Go It Alone — Don’t consider using a third party to lend support leading up to October 1 or to manage the workload for the few months afterward. Just load your key people with extra work; you’ll avoid the cost of short-term help for a few months. And there’s a good chance your staff won’t get burnt out.

3. Don’t Bother Contacting Your Payors, Software Vendors, and Clearinghouses — Do all your payors have the same claims filing deadlines and same coding requirements, and do all offer the same flexibility in terms of claims processing and resubmission? Then don’t bother reaching out to them.

4. Ignore Projecting How Your Cash Will (or Won’t) Flow — Avoid any attempt at assessing potential cash-flow disruptions due to claim denials. The predictive modeling tools and services available that identify likelihood of denials by payor and service type are for those who don’t want to use temporary loans.

5. Skip the Contingency Plan — Don’t identify any software companies, services, and coding resources that can handle specific tasks and/or supplement your internal staff prior to and/or after October 1. There should be plenty of help available whenever you need it — right up to the deadline.

ICD-10: The Real Deal

In reality, complying with the ICD-10 mandate is a nontrivial undertaking and dictates an importance that demands serious attention. Resources, many of which didn’t exist just a short while ago, can help you reach compliance with less cost.

Trend 1: Stage 2 MU

A Stage 2 MU Full-Court Press

By Ken Congdon, Editor In Chief

In more ways than one, achieving Stage 2 Meaningful Use (MU) has been a lot more complicated than providers bargained for. The latest set of MU criteria are infinitely more complex and demanding than the previous installment, and providers are having trouble making the leap from Stage 1 to Stage 2. Many were hopeful that they would get some relief in early December 2013, when chatter of a Stage 2 delay started to emerge from CMS and ONC. However, these hopes were short-lived when it was revealed that the Stage 2 attestation period would simply be extended through 2016. The delay to the start of the program that many had asked for would not be granted. Those deadlines would remain intact.

While already a priority for most providers prior to the announcement, confirmation from CMS that the start of Stage 2 would not be pushed back cemented a focus on MU initiatives. To successfully meet Stage 2 criteria, providers will have to make significant technology strides in 2014 — namely in the areas of integration and engagement.

The integration challenges are many. First, there’s the need to integrate health data from different proprietary EHR platforms with other EHRs and HIS (hospital information system) platforms. Leveraging HIE and programming interfaces are necessary to successfully share patient health data both internally and externally. The integration of medical images with EHR data required by Stage 2 is also proving to be a challenge for providers. For many, a significant investment in infrastructure upgrades and interfaces will be necessary to deliver this functionality.

The integration challenges are many. First, there’s the need to integrate health data from different proprietary EHR platforms with other EHRs and HIS (hospital information system) platforms. Leveraging HIE and programming interfaces are necessary to successfully share patient health data both internally and externally. The integration of medical images with EHR data required by Stage 2 is also proving to be a challenge for providers. For many, a significant investment in infrastructure upgrades and interfaces will be necessary to deliver this functionality.

The patient engagement requirements included in Stage 2 are proving to be the biggest concern for providers, not only because of the technology needed, but also the behavioral change that is required. Physicians will be expected to leverage more online and email tools to communicate with patients. This practice in itself is outside the comfort zone for many clinicians. Moreover, IT will be expected to ensure online communications are secure. Finally, providers are expected to enforce patient adherence to engagement policies — a requirement many providers feel is outside of their control. At any rate, providers must find ways to encourage at least 5 percent of their patients to download health information via a portal in order to receive Stage 2 incentive dollars.

As indicated by our survey, Stage 2 MU will undoubtedly drive much of the IT activity in the healthcare industry in 2014. Providers that successfully address these demands will have significantly moved the health IT needle. However, they must be careful not to lose their shirt in the process.